Investing Plan : Cicil Muatan?

Posisi ATH Terakhir :

23 Mei 2025 = $112.000

.

Yuk kita update lagi....

[update 30 Mei 2025 - investing plan]

- Exit $200.000 (over confidence!)

- Exit $150.000 (10% trailing stop)

- Exit $135,000 (20% posisi, jika momentum ekstrem).

- Exit $115,000 (5% posisi).

Apakah mungkin setelah koreksi ke 104.000 ini akan "lompat kodok" ???

Sebelumnya dari 70.000 ke 100.000 itu naik sekitar 42%...

Jika sekarang kita di kisaran 105.000 naik 42% berarti targetnya : $150.000

.

.

Estimasi waktu :

- Mei 23 : ATH 112.000

- Juni (buy more? 100K?)

- Juli (HIT 120K? -TP?)

- Agustus

- September 2025 (EXIT!!!)

- Hit ATH, akankah segera menuju "banana zone"

- 112.000 : ATH

- 109.300 : ATH Lama -> Resistance

- 104.000 : Area Cicil : Rp. 17200.000.000 (HIT! Cicil Done)

- 100.700 : Area Cicil : Rp. 1680.000.000

- 98.000 : Area Cicil : Rp. 1620.000.000

- 92.000 : Area Cicil : Rp. 1550.000.000

- 90.000 : Area BUY Rp. 1500.000.000

- 83.000 : Area BUY Rp. 1450.000.000

INDIKATOR :

Bull Market Peak : 0 / 30 : https://www.coinglass.com/bull-market-peak-signals

Bull Run Index : https://colintalkscrypto.com/cbbi/ (83 start sell)

https://www.bitcoinmagazinepro.com/charts/pi-cycle-top-indicator/ (Buy dibawah orange, HOLD sudah diatas orange - area BUY, nanti START SELL Ketika muncul garis merah)

https://www.bitcoinmagazinepro.com/charts/mvrv-zscore/ (merah : sell / hijau : buy)

- NUPL : 56% (Start sell 70% - Aggresive sell 75%, start buy 41% - di fase bullish)

- Mining Cost : ratio = 0,85 (mining cost : 91.000 -> sudah profit)

https://www.bitcoinmagazinepro.com/charts/puell-multiple/ (Miner Revenue - 1.51 Netral)

.

- Stock BTC di exchange : https://cryptoquant.com/asset/btc/chart/exchange-flows/exchange-reserve

- Fear & Greed : 60 (High 94 - Low 10)

- Marketcap : 2.136 T (top di 2,2 T)

- M2 Global Supply : Global M2 meningkat (ATH), BTC sudah ikut naik

- After Halving Comparison : masih di bawah performance halving sebelumnya

- Long Term Holder : jika 16 M BTC siap-siap (Tertinggi 16,29 M)

- Short Term Holder Realize Price : di area 95K : https://www.bitcoinmagazinepro.com/charts/short-term-holder-realized-price/

- Harga avg ETF / Instutusi / Negara

- Cheatsheet : https://www.bitcoinstrategyplatform.com/cheatsheet/ Area : Belief - Intermission

Dari Angga :

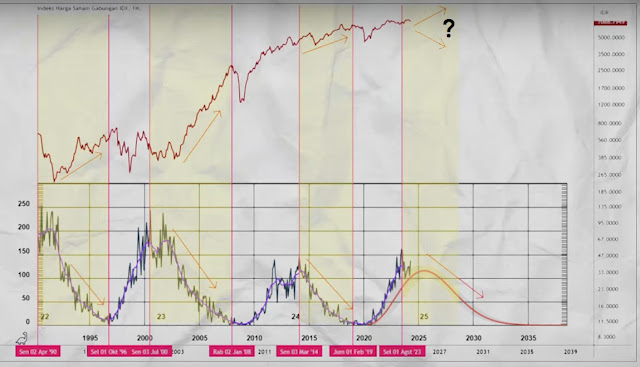

1. bitcoin power law (bitbo)

2. fair value logaritmic regression (sudah hit lower band - 104K)

3. stock to income (lower band 171K)

4. Quantile model (hit acceleration area - 109K)

5. Logaritmic regression band (non bubble fit : 85K. non bubble upper : 126K)

Dapetin Template Pensiun dengan Bitcoin :

=> https://trakteer.id/annasahmad/showcase

Komentar

Posting Komentar